Calfrac Announces Commencement of CBCA Stay Proceedings, Recapitalization Transaction and Financial Update

The CBCA is a Canadian corporate statute that, among other things, allows corporations to restructure certain debt obligations. In most cases, a corporation working through a CBCA process will be able to complete a recapitalization transaction in a more efficient manner based on time, cost and other key factors. The CBCA is not a bankruptcy or insolvency statute. All trade debt and obligations of the Company to employees, customers, suppliers and service providers shall be unaffected and shall be paid or satisfied in the normal course of business.

Preliminary Interim Order

The Preliminary Interim Order authorizes the Calfrac Applicants to apply to the Court to seek a further order under the CBCA Proceedings (the "Interim Order Application"), which would permit the Calfrac Applicants to call, hold and conduct the required special meetings (the "Special Meetings") of its affected stakeholders to consider and vote on a plan of arrangement to give effect to the Recapitalization Transaction (the "Arrangement"). In addition, the Preliminary Interim Order grants a stay of proceedings in favour of Calfrac and its subsidiaries in respect of any defaults that may result from Calfrac's decision to initiate the CBCA Proceedings, or arising in connection with Calfrac's previously announced election to defer the cash interest payment due on June 15, 2020, in respect of its outstanding Unsecured Notes, which were issued pursuant to an indenture dated May 30, 2018.

Recapitalization Transaction

Pursuant to the Recapitalization Transaction:

- Each holder of Unsecured Notes will receive newly issued Common Shares representing its pro rata share (based on the face value of the Unsecured Notes) of 86% of the pro forma issued and outstanding Common Shares in consideration for the exchange and transfer of the Unsecured Notes.

- Holders of Unsecured Notes who provide voting instructions to vote in favour of the Plan on or prior to a specified early consent date (which will be set pursuant to Court order) will receive additional newly issued Common Shares representing its pro rata share (based on face value of the Unsecured Notes) of 6% of the pro forma issued and outstanding Common Shares.

- The existing holders of Common Shares shall retain their Common Shares, subject to dilution based on the Common Shares issued to holders of Unsecured Notes. The existing holders of Common Shares will hold 8% of the pro forma issued and outstanding Common Shares following completion of the Arrangement.

- In connection with the Recapitalization Transaction, Calfrac will conduct a new money offering of new senior secured convertible 10% PIK notes (the "1.5 Lien Notes"), in an aggregate principal amount of $60 million (the "New 1.5 Lien Offering" or the "Offering"), as further described below. The proceeds of the New 1.5 Lien Offering will initially refinance indebtedness outstanding under the Company's credit facilities, creating additional liquidity. This liquidity will fund: working capital requirements as the Company's business improves in North America, from historic lows, maintenance capital for the Company's worldwide operating fleet, interest payments on the Company's debt obligations; and the payment of transaction costs associated with the Recapitalization Transaction. Completion of the Offering is contingent upon completion of the Recapitalization Transaction. The New 1.5 Lien Offering will be backstopped by the Initial Commitment Parties (as defined below) and the percentages of outstanding Common Shares above are subject to further dilution as a result of Common Shares to be issued in payment of the applicable backstop fee.

- Calfrac will be seeking any necessary amendments or waivers of its credit facilities as may be required to facilitate the Recapitalization Transaction. The lenders under Calfrac's credit facilities have waived any event of default that may result under such credit facilities as a result of the CBCA Proceedings.

- Holders of 10.875% second lien secured notes of Calfrac Holdings LP due 2026 (the "Second Lien Notes"), in their capacity as such holders, will be unaffected by the implementation of the Recapitalization Transaction.

- All trade debt and obligations of the Company to employees, customers, suppliers and service providers shall be unaffected by the Recapitalization Transaction and shall continue to be paid or satisfied in the ordinary course of business.

- As a result of the completion of the Recapitalization Transaction and the Offering, total debt will be reduced by approximately $570 million and annual cash interest expenses will be reduced by approximately $52 million.

- Following completion of the Recapitalization Transaction, there will be approximately 1,877 million Common Shares issued and outstanding (4,128 million Common Shares on a cumulative basis after giving effect to the issuance of the Common Shares issuable on conversion of the 1.5 Lien Notes, assuming conversion on the closing date of the Recapitalization Transaction).

Completion of the Recapitalization Transaction will be subject to, among other things, completion of the Offering, approval of the transaction by the affected security holders of Calfrac; other approvals that may be required by the Court, the approval of the Toronto Stock Exchange; and the receipt of all necessary regulatory approvals. In connection with the Recapitalization Transaction, the Company intends to continue under the CBCA.

Offering of 1.5 Lien Notes

In connection with the Recapitalization Transaction, Calfrac will conduct an offering of the 1.5 Lien Notes, in an aggregate principal amount of $60 million. The 1.5 Lien Notes will be issued to: (i) G2S2 Capital Inc., or an affiliate thereof ("G2S2") as to approximately $18 million of 1.5 Lien Notes; (ii) members of a supporting ad hoc committee of noteholders (the "Ad Hoc Committee") as to approximately $14 million of 1.5 Lien Notes; and (iii) MATCO Investments Ltd. ("MATCO") as to approximately $13 million of 1.5 Lien Notes (collectively, the "Initial Commitment Parties"), provided that the Company may allocate up to $6 million of such amounts (together with the associated backstop commitment) to other holders of Unsecured Notes on or before July 31, 2020 (together with the "Initial Commitment Parties", the "Commitment Parties"), which shall reduce the foregoing amounts pro rata. In addition, an additional aggregate of $15 million of 1.5 Lien Notes will be reserved for other holders of Unsecured Notes (subject to certain qualifying criteria). Each Commitment Party (other than G2S2 and MATCO) will subscribe for and backstop any portion of the $15 million of 1.5 Lien Notes reserved for other holders of Unsecured Notes on a pro rata basis and G2S2 as to the remaining amount. The Commitment Parties shall be entitled to an aggregate fee of $1.5 million in respect of such backstopped amount, payable in Common Shares following the conversion of the Unsecured Notes to Common Shares pursuant to the Recapitalization Transaction. G2S2 and the members of the Ad Hoc Committee have entered into support agreements with the Company.

The 1.5 Lien Notes will include the following terms:

- A term to maturity of three years from closing. The Company will have no right of redemption.

- The New 1.5 Lien Notes will bear interest at a rate of 10% per annum payable in cash semi-annually on March 15 and September 15 of each year (commencing on September 15, 2020, each, an "Interest Payment Date"). On each Interest Payment Date, the Company may elect to defer and pay in kind any interest accrued as of such Interest Payment Date by increasing the unpaid principal amount of the New 1.5 Lien Notes as at such date (each, a "PIK Interest Payment"), which PIK Interest Payment shall be allocated pro rata to all New 1.5 Lien Noteholders. Following each such increase in the principal amount of the New 1.5 Lien Notes as a result of any PIK Interest Payment, the New 1.5 Lien Notes will bear interest on such increased principal amount from and after the date of each such PIK Interest Payment. Upon repayment of the New 1.5 Lien Notes, any interest which has accrued thereon but has not been capitalized as set forth above shall be paid in cash. Upon and following the occurrence of an event of default that is continuing, the New 1.5 Lien Obligations shall bear interest at a rate equal to 2% above the applicable rate.

- The obligations in respect of the 1.5 Lien Notes will be fully and unconditionally guaranteed, jointly and severally, on a senior secured basis (the "1.5 Priority Lien") by the Obligors, and shall be secured over not less than all of the present and future existing collateral securing the Company's first lien credit facility and the Second Lien Notes. The 1.5 Priority Lien will form part of the Company's senior secured obligations and will rank: (a) senior to all of the Company's future obligations, unsecured obligations and the obligations of the Company in respect of the Second Lien Notes; and (b) junior to the obligations under the Company's credit agreement.

- The 1.5 Lien Notes will be convertible at the holder's option into Common Shares at any time prior to maturity at a conversion price of $0.0266 per Common Share (prior to giving effect to a share consolidation contemplated by the Recapitalization Transaction (the "Conversion Price"). The Conversion Price shall be subject to standard anti-dilution adjustments upon, among other things, share consolidations, share splits, spin-off events, rights issues, reorganizations and for certain dividends or distributions to holders of Common Shares.

- Upon the occurrence of certain changes of control, the Company will be required to offer to repurchase all outstanding 1.5 Lien Notes at a purchase price equal to 101% of the aggregate principal amount of the 1.5 Lien Note unpaid interest, if any, to the date of repurchase.

- The 1.5 Lien Notes will contain customary events of default.

- The 1.5 Lien Notes will contain customary covenants, representations and warranties for a senior secured note issuance. Pursuant to the 1.5 Lien Note indenture, the Company shall be required to obtain approval of holders of 1.5 Lien Notes holding not less than 66⅔% of aggregate principal amount of 1.5 Lien Notes (the "Consenting 1.5 Lien Noteholders") for certain fundamental events, including certain incurrences of debt; amendment of constating documents; the alteration of the Company's share capital; the increase of the size of the board of directors of the Company (the "Board") from seven (7) members; the making of change of control payments to directors, officers or employees resulting from with the Recapitalization Transaction; and entering into agreements which materially restrict the ability of the Company to conduct business.

- The Board will consist of seven (7) members. For so long as each of G2S2,the Ad Hoc Committee and MATCO, including their respective affiliates, shall own at least 50% of their respective initial 1.5 Lien Notes, they shall each have the right to nominate one (1) director to the Board.

- If one or more director nominees of the holders of 1.5 Lien Notes fails to be elected as a director, such nominee shall be designated an observer to the Board, and the Company shall be required to obtain approval of the Consenting 1.5 Lien Noteholders in respect of certain additional matters, including; purchases, sales or leases in excess of $25 million; or entering into related party transactions in excess of $0.5 million.

- The Initial Commitment Parties will be granted certain pre-emptive rights in connection with offerings of equity or debt securities by the Company.

Completion of the Offering is subject to, among other things, completion of the Recapitalization Transaction; the approval of the Toronto Stock Exchange and any shareholder approval required pursuant thereto; the approval of a majority of a minority of shareholders as required under Multilateral Instrument 61-101 ("MI 61-101"); and the receipt of all necessary regulatory approvals. Pursuant to MI 61-101, the Company intends to rely upon the exemption from the requirement to prepare a formal valuation in connection with the issuance of 1.5 Lien Notes to MATCO, as a related party of the Company, pursuant to the exemption contained in section 5.5(g) of MI 61-101. In connection therewith, the independent directors of the Board for such purpose, consisting of Gregory S. Fletcher, James S. Blair, Kevin R. Baker and Douglas R. Ramsay (the "Independent Directors") have determined unanimously that the Company is in serious financial difficulty, the Offering is designed to improve the financial position of the Company, and the terms of the Offering are reasonable in the circumstances of the Company. The Board has also made these determinations.

The transaction term sheets in respect of the Recapitalization Transaction, the forms of support agreement and the forms of consent agreements (in each case subject to redactions for certain confidential and/or commercially sensitive information contained in such agreements) will be filed on SEDAR under Calfrac's profile (www.sedar.com) and Calfrac's website (www.calfrac.com). Additional information in connection with the implementation of the Recapitalization Transaction, including with respect to CBCA Proceedings, will also be made publicly available by the Company.

Additional Information About the Recapitalization Transaction

Calfrac, with the assistance of the Company's legal and financial advisors, and in consultation with key stakeholders, conducted a review of potential alternatives available to the Company to address its outstanding debt, improve liquidity and strengthen its overall financial position. The Company has carefully reviewed and considered, among other things, its overall capital structure and financial condition, its debt levels and cash interest payments, the Company's previously announced decision to defer the June 15, 2020 interest payment on the Unsecured Notes, challenging industry conditions and the effects of the ongoing COVID-19 pandemic, and weakened commodity prices. In connection with this evaluation, the Company views the proposed Recapitalization Transaction and the Offering as achieving the Company's goals of improving its capital structure and liquidity.

Peters & Co. Limited ("Peters & Co."), an independent financial advisor to the Board, has provided opinions to the Board that: (i) the holders of Unsecured Notes and the existing holders of Common Shares would be in a better financial position, respectively, under the Recapitalization Transaction than if the Company were liquidated; and (ii) the Recapitalization Transaction is fair, from a financial point of view, to the Company.

Following the Company's review and consultation process, and after careful consideration and based on a number of factors, including the opinions of Peters & Co., legal advice from the Company's counsel, financial advice from the Company's financial advisors, the facts and circumstances facing the Company, the terms of the Recapitalization Transaction and the Offering, the Board unanimously determined that the Recapitalization Transaction is in the best interests of the Company, and unanimously recommends that holders of Unsecured Notes and Common Shares support and vote in favour of the Recapitalization Transaction.

Tudor, Pickering & Holt & Co. / Perella Weinberg Partners LP and RBC Capital Markets are acting as financial advisors to the Company, and Bennett Jones LLP and Latham & Watkins LLP are acting as legal counsel. Goodmans LLP is legal counsel to the Ad Hoc Committee.

Update Concerning Wilks Brothers

In the course of the CBCA Proceedings, Calfrac disclosed previously non-public information concerning prior discussions and correspondence with Wilks Brothers, LLC and its related parties (collectively, "Wilks Brothers"). Wilks Brothers holds approximately 19.78% of the common shares of Calfrac and, according to regulatory filings by it, over 50% of the Second Lien Notes. Wilks Brothers also owns ProFrac Services Ltd., a competitor of Calfrac in the U.S.; and has other publicly disclosed investments in oilfield services companies, some of which are also competitors of Calfrac.

The documents filed as part of the CBCA Proceedings disclosed the fact that Wilks Brothers submitted unsolicited, non-binding proposals to Calfrac on June 22 and June 29, 2020, respectively. Both proposals described prospective transactions whereby Wilks Brothers would acquire Calfrac's U.S. business in exchange for the Second Lien Notes of Calfrac held by Wilks Brothers at each of the relevant dates, and cash.

After reviewing the proposed transaction terms with its financial advisors, Calfrac firmly declined both proposals for two principal reasons. Most importantly, the consideration offered by Wilks Brothers significantly undervalued Calfrac's U.S. business, a division that represents more than two-thirds of Calfrac's global enterprise.

Further, neither Wilks Brothers proposal was considered by Calfrac's board of directors to be practical or executable. The Wilks Brothers' proposals sought to leave the first-lien, senior creditors of Calfrac with less than one-third of the collateral that they currently hold, with no debt reduction. In addition, a vastly disproportionate amount of debt was proposed to be left owing by Calfrac, after the proposed transaction, relative to what was suggested by Wilks Brothers to become Calfrac's remaining assets, collateral and operations.

Calfrac also disclosed in the materials filed for the CBCA Proceedings that Wilks Brothers has been a significant shareholder of Calfrac since at least 2016, and had self-identified in September of 2017 as an activist investor in Calfrac, who "may seek to effect material changes in [Calfrac's] business or corporate structure".

As disclosed in Calfrac's press release dated May 7, 2019, in a decision released on that date the Alberta Court of Queen's Bench granted Calfrac's summary judgment application and ruled that Wilks Brothers had breached its confidentiality agreement with Calfrac and dismissed Wilks Brothers motion for summary judgment. Calfrac's action is continuing in relation to damages issues.

Calfrac has confirmed as part of the CBCA Proceedings that it does not believe that separating Calfrac's U.S. business from the balance of the Company would be in the best interests of all stakeholders, particularly at below fair market value, and the significant amount of debt that would remain with Calfrac post the transaction as had been proposed by Wilks Brothers.

Financial Update

In connection with obtaining the Preliminary Interim Order, and the Company's ongoing negotiations concerning a Recapitalization Transaction, the Company is providing an update concerning its available debt capacity, as well as forecasts concerning certain financial measures.

Tables 1 illustrates the Company's current secured debt capacity as of April 30, 2020. As at April 30, 2020, the Company's actual cash balance was $51.4 million.

Table 1: Secured Debt Capacity (C$ in millions)

|

Secured Debt Capacity |

||

|

Based on Fixed Baskets |

||

|

Credit Facilities Starter Basket |

$375 |

|

|

General Liens Basket |

$84 |

|

|

Total Secured Debt Capacity |

$459 |

|

|

Less: Credit Facility Drawn |

($173) |

|

|

Available Lien Capacity |

$286 |

|

|

Less: Second Lien Notes Outstanding |

($167) |

|

|

Net Available Secured Debt Capacity |

$119 |

|

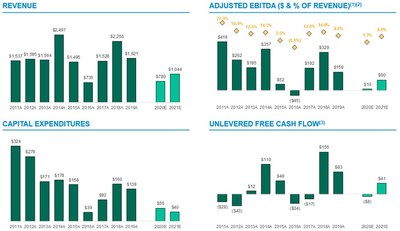

Table 2 illustrates the Company's historical and forecast financial performance as of April 30, 2020.

Table 2: Historical and Forecast Financial Performance (C$ in millions)

(Click here to enlarge image)

|

(1) |

Adjusted EBITDA is defined as net income or loss for the period less interest, taxes, depreciation and amortization, unrealized foreign exchange losses (gains), non-cash stock-based compensation, and gains and losses that are extraordinary or non-recurring. |

|

(2) |

With the adoption of IFRS 16, the accounting treatment for operating leases when Calfrac is the lessee, changed effective January 1, 2019. Calfrac adopted IFRS 16 using the modified retrospective approach and the comparative information was not restated. As a result, the Company's 2019 Adjusted EBITDA is not comparable to periods prior to January 1, 2019. For the year ended December 31, 2019, Adjusted EBITDA excludes $21.9 million of lease payments that would have been recorded as an operating expense prior to the adoption of IFRS 16. Estimated Adjusted EBITDA for 2020 and 2021 includes the impact of lease obligation principal repayments under IFRS 16. |

|

(3) |

Unlevered free cash flow is defined as net income or loss for the period less interest, taxes, depreciation and amortization, unrealized foreign exchange losses (gains), non-cash stock-based compensation, and gains and losses that are extraordinary or non-recurring less capital expenditures and changes in items of working capital. |

Certain measures presented in this press release, including Adjusted EBITDA and unlevered free cash flow, do not have any standardized meaning under IFRS and, because IFRS have been incorporated as Canadian generally accepted accounting principles (GAAP), these supplementary measures are also non-GAAP measures. These measures have been described and presented in order to provide additional information regarding the Company's forecasts, liquidity and ability to generate funds to finance its operations. These measures may not be comparable to similar measures presented by other entities, and are explained below.

Adjusted EBITDA is defined as net income or loss for the period less interest, taxes, depreciation and amortization, unrealized foreign exchange losses (gains), non-cash stock-based compensation, and gains and losses that are extraordinary or non-recurring. Adjusted EBITDA is presented because it gives an indication of the results from the Company's principal business activities prior to consideration of how its activities are financed and the impact of foreign exchange, taxation and depreciation and amortization charges.

Unlevered free cash flow is defined as net income or loss for the period less interest, taxes, depreciation and amortization, unrealized foreign exchange losses (gains), non-cash stock-based compensation, and gains and losses that are extraordinary or non-recurring less capital expenditures and changes in items of working capital. Unlevered free cash flow is presented because it gives an indication of the Company's liquidity prior to consideration of how its activities are financed and the impact of foreign exchange, taxation and depreciation and amortization charges.

Adjusted EBITDA and unlevered free cash flow for the actual periods noted below are calculated as follows:

|

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

||

|

(C$000s) |

||||||||||

|

(Unaudited) |

||||||||||

|

Net income (loss) |

187,157 |

96,361 |

26,733 |

67,502 |

(227,426) |

(203,557) |

586 |

(26,177) |

(156,203) |

|

|

Add back (deduct): |

||||||||||

|

Depreciation |

87,457 |

90,381 |

110,006 |

139,395 |

156,638 |

152,822 |

130,793 |

190,475 |

261,227 |

|

|

Unrealized foreign exchange (gain) loss |

11,945 |

(10,895) |

1,350 |

17,660 |

42,592 |

22,490 |

34,646 |

11,465 |

2,041 |

|

|

Non-recurring realized foreign exchange losses |

- |

- |

- |

- |

- |

- |

- |

29,288 |

- |

|

|

Loss (gain) on disposal of property, plant and equipment |

(88) |

802 |

(1,514) |

1,577 |

(2,257) |

(491) |

13,039 |

160 |

1,870 |

|

|

Business combination |

- |

- |

2,474 |

- |

(30,987) |

- |

- |

- |

- |

|

|

Impairment (reversal) of property, plant and equipment |

- |

- |

- |

4,620 |

114,479 |

- |

(76,296) |

115 |

2,165 |

|

|

Impairment of inventory |

- |

- |

- |

- |

14,333 |

3,225 |

- |

7,167 |

3,744 |

|

|

Impairment of goodwill |

- |

- |

- |

979 |

9,544 |

- |

- |

- |

- |

|

|

Provision for settlement of litigation |

- |

- |

- |

4,640 |

3,165 |

- |

(139) |

- |

- |

|

|

Restructuring charges |

- |

- |

- |

7,907 |

13,533 |

7,892 |

1,131 |

1,076 |

6,049 |

|

|

Losses attributable to non-controlling interest |

294 |

785 |

1,181 |

547 |

491 |

30 |

5,353 |

7,989 |

- |

|

|

Stock-based compensation |

8,500 |

6,990 |

5,454 |

4,138 |

3,082 |

2,361 |

4,985 |

5,812 |

4,626 |

|

|

Interest |

35,489 |

36,354 |

41,985 |

59,584 |

68,967 |

80,110 |

85,450 |

106,630 |

85,826 |

|

|

Income taxes |

88,579 |

41,375 |

7,209 |

48,746 |

(114,097) |

(109,632) |

(7,725) |

(4,592) |

(52,226) |

|

|

Adjusted EBITDA(1) |

419,333 |

262,153 |

194,878 |

357,295 |

52,057 |

(44,750) |

191,823 |

329,408 |

159,119 |

|

|

Deduct: |

||||||||||

|

Capital expenditures |

(323,962) |

(279,017) |

(170,517) |

(177,585) |

(157,934) |

(38,707) |

(91,933) |

(159,764) |

(139,305) |

|

|

Add back (deduct): |

||||||||||

|

Changes in items of working capital |

(122,972) |

(25,788) |

(12,842) |

(69,245) |

154,691 |

49,906 |

(117,188) |

(13,638) |

62,696 |

|

|

Unlevered free cash flow |

(27,601) |

(42,652) |

11,519 |

110,465 |

48,814 |

(33,551) |

(17,298) |

156,006 |

82,510 |

|

|

(1) |

With the adoption of IFRS 16, the accounting treatment for operating leases when Calfrac is the lessee, changed effective January 1, 2019. Calfrac adopted IFRS 16 using the modified retrospective approach and the comparative information was not restated. As a result, the Company's 2019 Adjusted EBITDA is not comparable to periods prior to January 1, 2019. For the year ended December 31, 2019, Adjusted EBITDA excludes $21,893,000 of lease payments that would have been recorded as an operating expense prior to the adoption of IFRS 16. |

|||||||||

A specific reconciliation of forecast Adjusted EBITDA and unlevered free cash flow to net income or loss is not possible as the applicable GAAP measures have not been determined.

Calfrac's common shares are publicly traded on the Toronto Stock Exchange under the trading symbol "CFW". Calfrac provides specialized oilfield services to exploration and production companies designed to increase the production of hydrocarbons from wells drilled throughout western Canada, the United States, Argentina and Russia.

All references to "$" are to Canadian dollars, unless otherwise indicated.

This press release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. The use of any of the words "expect", "anticipate", "continue", "estimate", "may", "will", "project", "should", "believe", "plans", "intends" and similar expressions are intended to identify forward-looking information or statements. More particularly and without limitation, this press release contains forward-looking statements and information relating to the completion of the proposed Recapitalization Transaction and the Offering, including expected reductions in total debt and cash interest expenses, and the Company's intentions and expectations, including forecasted financial results.

These forward-looking statements and information are based on certain key expectations and assumptions made by Calfrac in light of its experience and perception of historical trends, current conditions and expected future developments as well as other factors it believes are appropriate in the circumstances, including, but not limited to, the following: the Recapitalization Transaction and the Offering will be completed as proposed, economic and political environment in which Calfrac operates; Calfrac's expectations for its customers' capital budgets and geographical areas of focus; the effect unconventional oil and gas projects have had on supply and demand fundamentals for oil and natural gas; Calfrac's existing contracts and the status of current negotiations with key customers and suppliers; the effectiveness of cost reduction measures instituted by Calfrac; and the likelihood that the current tax and regulatory regime will remain substantially unchanged.

Although Calfrac believes that the expectations and assumptions on which such forward looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information as Calfrac cannot give any assurance that they will prove to be correct. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with: Calfrac's ability to continue to manage the effect of the COVID-19 pandemic on its operations; default under the Company's credit facilities and/or the Company's senior notes due to a breach of covenants therein; failure to reach any additional agreements with the Company's lenders; the impact of events of defaults in respect of other material contracts of the Company, including but not limited to, cross-defaults resulting in acceleration of amounts payable thereunder or the termination of such agreements; failure of existing shareholders and holders of Unsecured Notes to vote in favour of the Recapitalization Transaction; failure to receive any applicable regulatory approvals in respect of the Recapitalization Transaction or the Offering, global economic conditions; along with those risk and uncertainties identified under the heading "Risk Factors" and elsewhere in the Company's annual information form dated March 10, 2020 and filed on SEDAR at www.sedar.com.

The forward-looking statements and information contained in this press release are made as of the date hereof and Calfrac does not undertake any obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. This press release is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent an exemption from registration under the Securities Act of 1933.

SOURCE Calfrac Well Services Ltd.

![]()